3 Things 5-24

- kdmann32

- Jun 9, 2021

- 4 min read

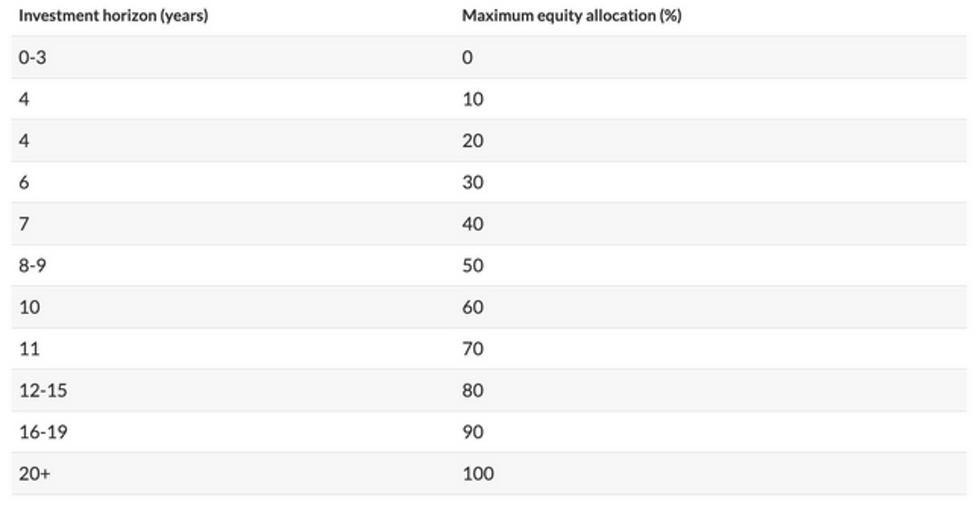

05/24/2021 Although MAS is a financial services company, not everything published herein will be about numbers or investing. But no matter the topic, we hope for three things: 1) That you find the time you spend engaged worthwhile. 2) That you’ll reach out to us for help in any of our areas of expertise if something we discuss creates an urging in you to do so. 3) That you’ll share this with somebody new each time you read it. Thing One How Much Should You Have Invested In Stocks? While there are many financial practitioners who will answer this precisely after you provide them a few pieces of information, there is really is no one “right” answer to this question. That said, there are some very useful guides that you can use to help you decide on an appropriate number for your situation. For example, the chart below suggests that if your investment horizon, the period of time from now until you actually need to use the money, is zero to three years, you should not have anything in stocks while if you have a more than twenty-year investment horizon, you should have all of your available investment dollars in stocks. Now, before you run with this, remember there are no absolute formulas and there are potentially lots of things that can make person A’s number different from person B’s. Chief among them would be how the term, "investment horizon", is defined in detail. In other words, what does the end of the horizon represent, death or retirement or something else? Do they need to use all the money at once at the end of the horizon? If they don’t need to use all the money, how much risk are they willing to take with the “spare cash”? The questions can go on and on, but you get the point. It’s a useful guide but not a one-size-fit-all solution. As always, you should know we can help you or people you know and care about work through what makes the most sense in your specific situation. Just reach out or let them know to do the same.

Thing Two Here's To Good Friends I’ve recently gotten some feedback from a few readers who've pointed out how they've shared either the newsletter or an idea they read in it with people they know. One of the commenters is a person who has been a good friend for a long time and is now a good friend and a client. In a joking way, he suggested, after noting that I referred to friends in some of the things I'd written, that he wished he was a good enough friend to somehow be referred to in the newsletter. Well, he’s getting his wish today via a story about his unknown influence on me from the good ol’ days and the lesson it held for me that I think is worth sharing. For those that don’t know, I played college basketball. The old friend I referred to above was a former teammate. He was an over-the-top military and fitness enthusiast and, as a result, he was very much into strength training. Anyone who has played the game at a level past high school will tell you how physical it can be and how critical to success (for most people) strength training is. While I was in the top five or six in terms of basketball talent, I was dead last, or DFL as one of my assistant coaches liked to refer to it, in the strength department and it was apparent to me every time I stepped on the floor that my weakness (literally) was being exploited. During that same time, when we would weight train as a team, I would watch my old friend slinging around weight that I wouldn’t dare lay under. In one particular instance, which is seared in my memory, he described a technique he called “negatives” in which you actually get as much “work” from lowering the weight as you do from lifting it. When all was said and done a few years later, I was in the top two or three in both the basketball talent area and in the weight room all because of how I interpreted my disadvantage. The combination led to more success than I would have otherwise had playing the game. What was the retrospective lesson? Well, I was physically weaker than everyone on the team, but nobody could stop me from getting stronger – and actually, nobody wanted to stop me. On the contrary, most people were interested in helping me get stronger. I learned it wasn’t about lightening the weight load or getting someone to level the playing field. Both of those are typically bad ideas. The first one is a shortcut to a lesser goal and the second one is a scam solution peddled to us by people preying on our very human tendency to blame others for our problems. I don’t think I’ve ever been on a playing field of any kind that wasn’t level. But, to the extent that there was some defect – a slippery surface, a dead spot in the floor, or a bent hoop - all the participants were subject to the same conditions. So it is in the real world. We are all on the same playing field. Some of us are weak, some of us are strong. Some of us are prepared, some of us are unprepared. As individuals, we can all get stronger and become more prepared. Just like my friend showed me, we can turn the "negatives" into positives, if we choose, or we can listen to the voices, wherever they come from and whatever their interests and motivations, that tell us that our weakness or unpreparedness is someone else’s fault and can only be remedied by them and people like them. We should know upfront though that if we choose the latter, we will be giving away our individual power to change our circumstances to people who may only be interested in exploiting our weaknesses. We should also know that no matter what they say, those people don’t really have the capability of doing for us what we have decided we can’t do for ourselves.

Thing Three Just A Thought "The question isn't who is going to let me; it's who is going to stop me." -Ayn Rand

Comments