3 Things 1-26-26

Thing One Tax Season 2026 Is Here: What’s Different This Year (and Why You Should Care) If you’re filing your 2025 taxes and things feel a little unfamiliar, you’re not imagining it. Tax season 2026 is the first one shaped by the new tax law passed last summer, and it brought a mix of bigger deductions, new credits, extra forms, and fewer free filing options. Even if your income didn’t change much, the rules around it probably did. The good news? Many deductions are lar

3 Things 1-19-26

Thing One When Medicare Advantage Works—and When It May Be Challenging Recently, I worked with a client enrolled in a Medicare Advantage plan who experienced a serious fall. Following the injury, the client required skilled nursing care. When the family began exploring facility options, they learned that the nursing home they preferred was not part of the plan’s provider network. This created additional challenges at an already stressful time and highlighted some of the p

3 Things 1-12-26

Thing One Three Financial Resolutions That Would Be a Smart Move for 2026 As you’re working on maintaining those resolutions you made on New Year’s day, here are three financial resolutions you might considering adding. We believe they would serve most people well in 2026. First, resolve to get clearer on your cash flow. Before returns, before markets, before strategy—cash flow matters. Knowing where money is coming in, where it’s going, and what flexibility you have creates

3 Things 1-05-2026

Thing One Don’t Let the Court Write Your Final Plan Picture this: After a lifetime of hard work, you’ve built meaningful assets and settled into a comfortable retirement—then you pass away unexpectedly, without a will. It’s not something most people want to contemplate, and for you, there would be nothing left to contemplate. For those you leave behind, however, there would be much to consider, including the hardships that would ensue as a result of your not having a will

3 Things 12-29-25

Yahoo FInance had a couple of good articles last week that we thought we'd share a synopsis of in this week's newsletter as they echo sentiments we have often expressed. See both below: Thing One What a Comparison of $500,000 vs. $1 Million Reveals About Retirement The first article titled “I Asked ChatGPT To Compare Retiring With $500K vs. $1 Million — The Difference Is Huge,” explored how dramatically retirement outcomes can change based on the size of one’s nest

3 Things 12-22-25

Thing One How Lower Reinsurance Prices Could Put Money Back in Drivers’ Pockets After several years of rising premiums, the auto insurance market may be approaching a turning point. One of the most important forces behind the recent wave of rate increases — reinsurance costs — is beginning to ease, and that shift could set off a new phase of competition among car insurers, including selective rate reductions aimed at gaining market share. Reinsurance is essentially insu

3 Things 12-15-25

Thing One Plain Talk From A Politician On Inflation The following is a transcript from a town hall where conservative Canadian politician, Pierre Poilievre, was asked a question about inflation. In answering it, he explained the concept in a way that can be easily understood by anyone. See below: Questioner (off-camera): What are the steps I need to take in fixing the damages done by inflation? Pierre Poilievre: “First and foremost, stop the overspending. Inflation,

3 Things 12-8-25

Thing One Where the S&P 500 Could Go Next — And What That Means for Your Money Every year, Wall Street rolls out its forecasts for where the S&P 500 is headed. And every year, we’re reminded of the same truth: nobody actually knows. That’s said, there are credible arguments for strong upside, little to no upside, and meaningful downside between now and the end of next year. Still, it’s helpful to understand the range of possibilities investors are talking about. On the op

3 Things 12-1-25

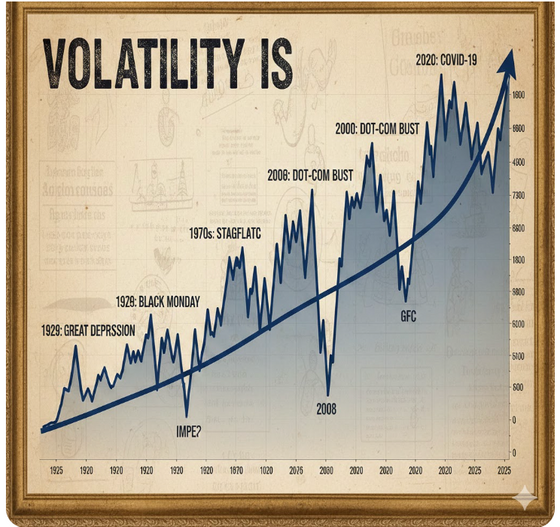

Thing One What The Last Three Major Market Crashes Teach Us About Long-Term Investing Market history is full of declines, but only a few reach true “crash” status — deep, prolonged drawdowns that shake investor confidence and reset entire economic cycles. The last three such events all delivered peak-to-trough losses of 34% to 57% , each triggered by a different spark, each with a different recovery timeline, and each ultimately rewarding investors who stayed the course. Here

3 Things 11-24-25

Thing One The 2025-26 HSA Update (And What It Means For You) If you haven’t reviewed your health-savings strategy in a while, now’s a good time. Two major changes are coming up for Health Savings Accounts (HSAs): higher contribution limits and broader eligibility thanks to changes in how Bronze-level health plans qualify. What’s an HSA and Why Is It So Good? An HSA (Health Savings Account) is one of the most tax-efficient tools you can use. It lets you set aside money befor